I love a good fight.

When it comes to U.S. energy production, I can’t think of a more controversial topic since Edwin Drake drilled his well on Pennsylvania soil over 150 years ago…

It all revolves around hydraulic fracturing.

Here’s the part that most people don’t seem to realize: Without fracking, the entire North American oil and gas industry would come to a screaming, painful halt. This is the reality we all need to face, regardless of protesters who abhor the fracturing process.

Hydraulic Fracturing 101

Let’s start from the beginning…

Hydraulic fracturing is a simple process, really. It’s used to create fractures in a rock formation by injecting the rock with a mixture of water, proppant (think: sand), and chemicals.

Once opened, the fissures allow the oil and gas resources to flow more freely into the well, which can then be extracted through the well bore.

Here’s a video of this procedure in action.

Although fracturing technology has roots that date back to the Civil War, the first case of hydraulic fracturing actually took place in 1947 when a company by the name of Stanolind Oil Company used it on a well in Kansas.

In 1949, another company came along and began using their patented HydraFrac Process. You might have heard of the company before… It goes by the name of Halliburton.

The controversy surrounding the technique and its impact on the environment didn’t reach a feverish pitch until a few years ago.

Why did it take over fifty years to come under fire? The answer to that question can be found within the wildly successful developments in our tight oil and gas plays…

Something Old, Something New

It’s no secret that U.S. oil production peaked in 1970 — nor is it that we increasingly rely on unconventional sources for oil and gas.

Even by using this projection from the EIA, we still won’t come within 20% of our Peak Oil output of 10.44 million barrels per day in October of 1970.

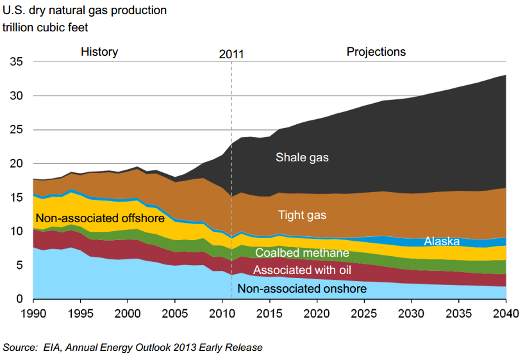

And we’re seeing the exact same situation in our domestic natural gas production:

Without taking advantage of hydraulic fracturing technology, we can go ahead and eliminate all of the tight oil and gas production on those charts.

Of course, the situation gets worse when you look deeper into the United States’ drilling stats: Right now, approximately 65% of all rigs operating on U.S. soil are drilling horizontal wells. And I can’t emphasize enough that every single one of those wells need to receive some form of fracture stimulation.

Some industry insiders have suggested nearly nine out of every 10 new wells will need to be fracked.

If you think the public is irate about $4/gallon gas prices (and I realize many readers have been and are paying much more than that now), imagine how they’ll feel when they’re being charged double, even triple, that amount.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Something Blue

Now let’s dive into the gripes people have with hydraulic fracturing…

It all comes down to watInvesting in Hydraulic Fracturinger. To be more specific, it all comes down to the fluid that is flushed down the well during the process… millions of gallons of frac fluid.

Since the composition of this frac fluid is the issue, it’s good to know 99.5% of it is water and sand.

And here we come to the point of no return for most anti-frackers: water contamination — that is, the threat of this frac fluid reaching someone’s water source.

Note: No matter how many times they argue it, there’s never been a case of frac fluid migrating up to the water table.

In a typical well, the rock formation being fractured lies at a depth of more than 7,500 feet. Water aquifers are usually found at a depth of 1,000 feet. Between the two is a mass of solid rock.

Investing in Hydraulic Fracturing

Of course, there’s a direct way to invest in hydraulic fracturing. As you know, companies like Halliburton have been around for a long time.

But I prefer the pick-and-shovel plays able to take advantage of the fact that we’re locked into using this technology — with increasing dependence…

Believe it or not, there are companies out there whose sole objective is to mine sand and other materials to sell to companies that perform the frac jobs.

One company, CARBO Ceramics (NYSE: CRR), manufactures ceramic proppant to use in place of sand. And the results speak for themselves, as drillers are able to increase production and EURs (the quantity oil and gas believed to be ultimately recoverable in a reserve or well) due to the uniformity of the ceramic proppants compared to sand.

Take a look:

If you know where to look, you will find other potential powerhouse stocks that will be making gains no matter how low oil or natural gas prices fall.

These smaller plays are the real cash cows in the energy boom. Wall Street will be buying hand over fist once these relatively unknown stocks reach their radar…

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.